What’s Behind the Exploding Prices of Pro Sports Franchises?

Teams were once considered poor, unpredictable investments. Today they’re among the most coveted assets in the world. What changed?On Wednesday, September 21, Robert Sarver, the embattled owner of the Phoenix Suns and Mercury, announced that he would be looking into selling his teams. He didn’t sound altogether pleased about the development—in the statement he blamed “our current unforgiving climate” for forcing him to explore a sale—though it’s hard to believe he can really be all that upset. Today Forbes estimates the value of the Suns at $2.7 billion. Others, however, think the Suns’ final selling price could be as high as $4.5 billion. Sarver purchased a controlling interest in the Suns at a valuation of $401 million, in 2004.

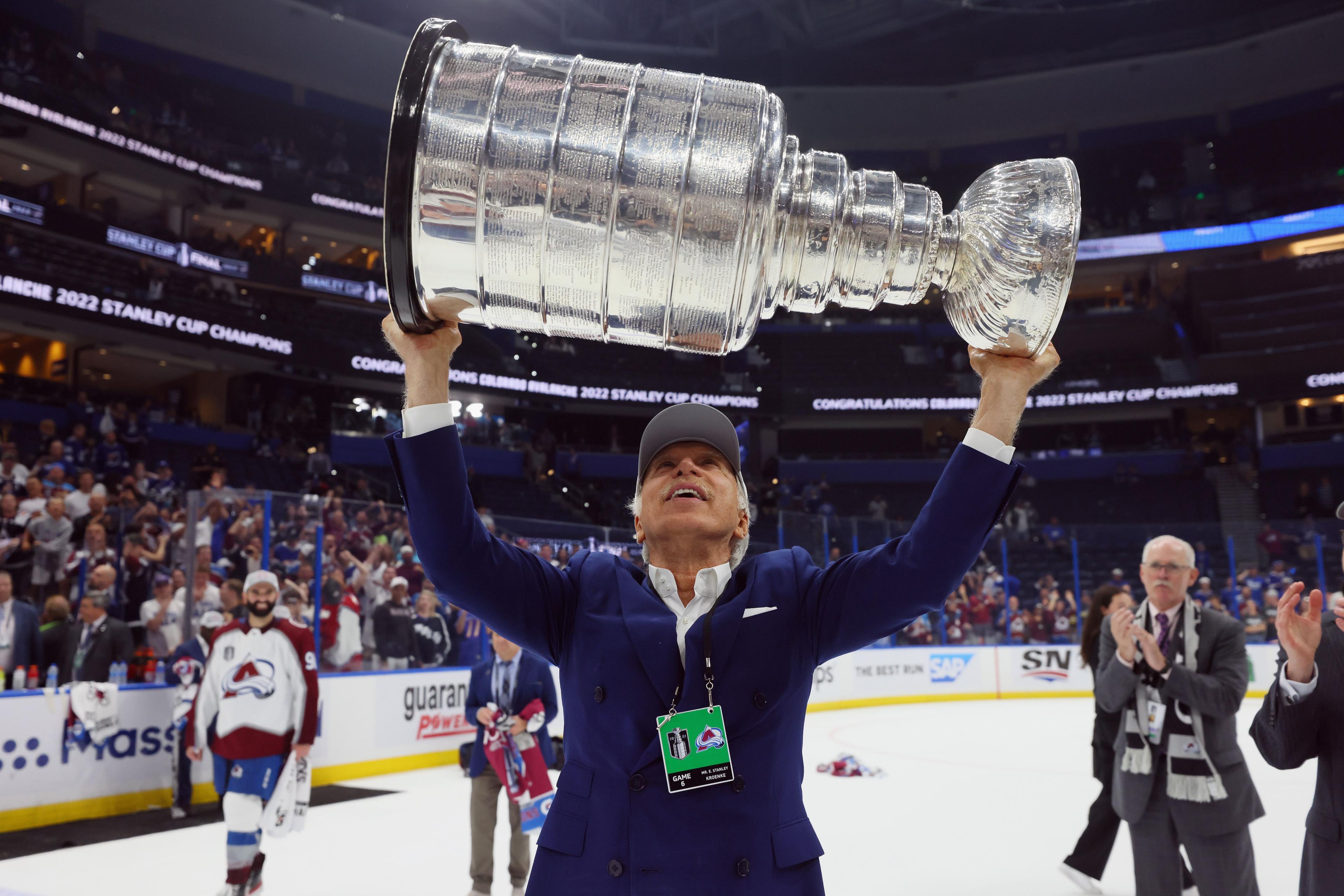

On its face, such a return seems remarkable; few would have guessed, when Sarver purchased the Suns 18 years ago, that the team would appreciate at least sixfold. But what’s really remarkable about it is that, in pro sports these days, such a return isn’t that remarkable. Earlier this year, a group of investors led by Rob Walton, heir to the Walmart fortune, paid $4.65 billion for the Denver Broncos. (The team’s previous owners, the Bowlen family, had purchased the Broncos for $78 million, in 1984.) That was the most anyone had ever paid for a pro sports franchise, but just earlier this month, Dan Snyder—the also-embattled owner of the Washington Commanders—announced that he, too, would consider selling his team. Snyder purchased the Commanders for $800 million in 1999. Some think he’ll sell for $7 billion next spring.

Over the past 40 years or so, every single team in all four of the United States’ major sports has increased exponentially in value—inexorably through all manner of catastrophe, and at an average rate that far outpaces that of both inflation and the S&P 500. (As Forbes recently reported, the average NBA team is 15 percent more valuable than a year ago; as of November, the S&P was down 15 percent over the same span.) The Golden State Warriors, at $7 billion, are today worth 61 times what they were worth in 1996, and 16 times more than the $450 million that Joe Lacob and Peter Guber paid for them in 2010. That’s tops, so far as most dizzying increases in monetary value go, but it’s not atypical. From 2012 to 2021, on average, NBA values increased 387 percent, according to Sportico. Since 1996, the average NHL team has seen its value go up 1,112 percent. Even the Oakland A’s, who play a sport from which fans are fleeing, and into whose on-field performance owner John Fisher has invested nearly nothing during his tenure—and who play in a stadium once poetically described as a concrete toilet, which this year reported the lowest attendance numbers in all of baseball—have seen their value go up from $180 million, in 2005, to $1.34 billion today. (If you were lucky enough to buy and hold on to a much older franchise, meanwhile—like the Chicago Bears, which the McCaskey family purchased for $100 in 1920—the return on your investment would dwarf even these large numbers; as of 2020, the return on the McCaskeys’ investment sat at 3,449,990,800 percent.)

What’s interesting about this is not the gaudiness of the accounting, but rather what changes to the culture and pedigree of pro sports the gaudiness reveals. It’s tempting to assume that team values always have been relatively high, and that, moreover, pro teams always have been rewarding things to own. Recall the old adage that sports is a business. Hasn’t business always been pretty good?

Not exactly. What pro teams are to the people who buy and sell them has changed dramatically over the years, as have the people who buy them. I’m painting in broad strokes here, but for much of the 20th century, pro sports attracted a generally brazen, craftily craven kind of entrepreneur. Far from the likes of Rob Walton—e.g., dynastically wealthy people with patrician manners so stately their profiles wouldn’t appear out of place on coins—these were people who tended not to be lavishly wealthy, but who tied up what wealth they did have indiscriminately in their teams. They also tied up the whole of their eccentric entrepreneurial ambitions in their teams’ economic success, which sometimes impoverished them. For an extreme-yet-templatizing example, see the career of Christian Friedrich Wilhelm von der Ahe, a hard-drinking Prussian immigrant who moved to St. Louis in 1870. He opened a saloon, and, 10 years later, connived his way into a controlling stake of the nascent St. Louis Base Ball Association, which operated the St. Louis Brown Stockings. Von der Ahe purchased the Brown Stockings not because he knew anything about baseball—he didn’t—but because the young men who patronized his saloon wouldn’t stop talking about their games. So von der Ahe cut a check for $1,800 to purchase the club, and then built them a ballpark next door. He called it Sportsman’s Park.

Thanks to sound investments in his on-field product—future Chicago White Sox owner Charlie Comiskey was hired to manage and play first base—the team, which he renamed the Browns, found success, placing first in the American Association four years running. Attendance, both at Sportsman’s Park and in von der Ahe’s saloon, swelled. Things were good enough that von der Ahe felt justified erecting a statue of himself outside the Browns’ stadium. As the years went on, however, the team’s fortunes soured. Von der Ahe invested in an ever-more-expensive coterie of embellishments and concessions, starting with hot dogs and beer before graduating to more outlandish fare, such as on-field horse tracks and outfield amusement parks. By 1892, the Browns had fallen into 11th place in the 12-team league. Attendance dwindled. One day, a not insignificant portion of a new park that von der Ahe had built for the Browns burned down. Debts accumulated. His wife divorced him. Bondsmen kidnapped him. Finally, von der Ahe lost the Browns to debtors. He died not long after of cirrhosis of the liver. The statue that had once stood sentry outside Sportsman’s Park adorned his grave.

Call it a typifying tale. In the years that followed, buyers who dared to dip their toes in the pro sports business were often of the von der Ahe mode. Picture Charlie Finley, who purchased the Kansas City A’s in 1960 with money he made in the insurance business, organizing cow-milking competitions before games to boost flagging attendance. Or Jerry Buss, the real estate magnate who sunk all his money into the Los Angeles Lakers, in 1979, grinning anarchically from center court as he introduced the world to the Laker Girls, whom he hoped might help him fill the then-dormant Los Angeles Forum. Or Bill Veeck, author of the seminal text on the business of team ownership, The Hustler’s Handbook—and who at various points in the 1940s and ’50s owned three different MLB teams—subbing Eddie Gaedel, who stood 3 feet 7 inches, as a pinch-hitter in the first inning of a not-unimportant regular-season game. Or George Steinbrenner, who hired and fired 19 managers, five team presidents, and 13 general managers over the first two decades of his tenure, 1973 to 1990, as owner of the New York Yankees. Or even Jerry Jones, who liquidated most of his net worth to purchase the Dallas Cowboys, who were losing $1 million a month, in 1989, and proceeded to immerse himself holistically into the Cowboys’ operations—“down to the jocks and socks,” as he once bragged to The New York Times. Not every owner was so eccentric. (Many pro teams were and still are owned and operated as family businesses, for example.) But up until the modern era, the most prominent team owners could be pretty accurately categorized as iconoclasts: hucksters, hustlers, dreamers, and drunks who were not afraid to buck convention.

The reason for this was pretty simple, and brings us to the second point: Investments in pro sports were not thought conventionally prudent; as Victor Matheson, economics professor at College of the Holy Cross, told me recently, “The idea that [pro sports] is a money-losing proposition was still right there in people’s minds as late as the 1990s.” He cited a separate adage. “‘How do you become a millionaire? Start out a multimillionaire and buy a sports team.’”

All of this, however, has changed. Today pro sports teams rank among the most reliably lucrative, rabidly coveted investment opportunities there are. They’ve proved practically impervious to the busts, recessions, foreclosure crises, and plagues that have at the very least stalled growth in other industries. From 1996 to 2004, the average NFL team appreciated 321 percent (the S&P 500, by comparison, appreciated by 97 percent); as Lev Akabas, a reporter with Sportico, put it to me recently, pro teams have become “a dream investment.”

And the kind of people who buy pro teams now? They’re figures like Steve Ballmer, former CEO of Microsoft, who purchased the Los Angeles Clippers for $2 billion in 2014; David Tepper, a “golden god” hedge fund manager who purchased the Carolina Panthers for $2.2 billion in 2018; and Steve Cohen, a hedge fund manager worth $17.5 billion who bought the New York Mets for $2.4 billion in 2020. (The list of aspiring team owners is even more eye-popping; it includes Disney CEO Bob Iger, who’s been floated as a potential buyer of Sarver’s Suns, and Amazon founder Jeff Bezos and Oracle founder Larry Ellison, both of whom have been highlighted as candidates to buy the Commanders.

In a way, pro teams are to today’s global dynastic elite what railroads, rare paintings, and opulent manors were to the robber barons of von der Ahe’s age: preeminent sources not only of profit, but of celebrity and status. It’s an unprecedented shift. (Von der Ahe, one imagines, is rolling in his grave.) How did it happen?

1. The Rise of Television

The story of how pro teams morphed from what they were for most of the 20th century to what they are today is complex (the economics professors I talked to for this article told me they dedicate entire semester-long courses to it), but ultimately it comes down to the transformation of pro teams from products to assets, which owners don’t run or use so much as collect.

And that story starts with the rise of television. Before TV, pro sports were a resolutely regional enterprise. Team owners made most of their money by persuading fans to attend games. A fickle endeavor, to be sure, imminently susceptible to the foibles of foul weather and poor play, but that was the business. What money did come from TV distribution was minimal. In 1946, for example—a time when only a small percentage of Americans owned television sets—radio contracts and television deals together contributed to only 3 percent of Major League Baseball’s annual revenues.

That changed as television became more popular, and networks awoke to the potential of pro sports as an advertising vessel. By the 1960s, 87 percent of U.S. households had a TV. And increasingly, what those households wanted to watch was sports. The interest sparked a bidding war among networks that hasn’t abated since. “For all the competition in news programs, westerns, detective shows, situation comedies and documentaries,” Broadcasting magazine reported in 1963, “there is no fiercer competition than the ‘utter demand’ for sports.” That same year, CBS made an at-the-time record bid of $28.2 million for the right to broadcast NFL games 17 days a year.

Lavish media-rights deals have sustained pro sports ever since. Today, Disney pays the NFL $2.7 billion a year for the rights to Monday Night Football and two Super Bowls. For team owners, in-game attendance is now but a tertiary concern. For example, the Packers, who as a publicly owned team have open books, saw nearly 60 percent of their total 2021 revenue come from the NFL’s TV and sponsorship deals, which are split evenly by the league’s 32 clubs. As Michael Leeds, professor at Temple University and coauthor of Economics of Sports told me, “Sports teams don’t need fans in the stands anymore to be profitable.”

For team owners this amounted, in practice, to a kind of liberation. It also greatly increased the appeal of pro teams as an investment opportunity. The underlying logic is simple, but it’s worth rehashing. Large media-rights deals create for team owners tactically undemanding sources of revenue. And what investor doesn’t love a tactically undemanding revenue source? Sure enough, each time a new media-rights deal is signed these days, team values jump. As Sportico has reported, the NFL’s largest single-year increase in average franchise value, which occurred in 1998, along with the NHL’s two largest increases—1998 and 2013—were “all accompanied by a more than doubling of those leagues’ media-rights values.” The same is true of the NBA’s recent explosion in average franchise value, which began in 2014, when the league signed a media-rights extension worth $24 billion with ESPN and Turner. (The NBA will need a new deal following the 2024-25 season, and it could get as much as $75 billion.)

2. Cartel Status

But the rise of TV and the advent of multibillion-dollar media deals did not on their own turn pro teams into the highly coveted investments that they are today. Team valuations did go up along with media-rights deals, to an extent—CBS bought the Yankees for $14 million in 1964, which was some $11 million more than what Dan Toplin and Del Webber had paid for the team 20 years earlier, according to The New Yorker—but they fluctuated. When CBS sold the Yankees to Steinbrenner in 1973, the company took a loss.

In fact, media-rights deals would never have been so profitable or concentrated were it not for team owners’ state-sanctioned license to collude with each other roughly in the manner of drug cartels. This is most easily seen with Major League Baseball, where this license is merely an extension of the sport’s legally enshrined right to monopolize.

As evidenced by the existence of the American Association of Base Ball Clubs, in which von der Ahe’s Browns competed—and which was one of a handful of professional baseball leagues operating in the United States at the time—pro baseball in America was once a comparatively rich ecosystem consisting of several different competing leagues. In 1903, the heads of the sport’s two most successful leagues, the American and National leagues, joined to form Major League Baseball. The benefits of consolidation were obvious: less competition lowered the risk that the leagues would effectively cannibalize each other in competition over players and fans, for example. There was only one problem: This was illegal. In 1915, the Federal League, the only remaining professional league aside from the Negro Leagues, called its competitors out on their bullshit. It should have worked. For several years by that point, the NL and AL had been buying out owners of Federal League teams, with the intent of putting that league out of business. By 1915 there was only one Federal League team left, the Baltimore Terrapins. That year, in a kind of last stand, it sued the NL and AL, stating—correctly, obviously—that the two leagues had attempted, in violation of the Sherman Antitrust Act, to monopolize professional baseball. The resulting case was Federal Baseball Club of Baltimore v. National League, which in 1922 rounded third on its way to the Supreme Court.

In any other context or industry, the Federal League probably would have won this case. But in perhaps the most consequential legal decision in the history of pro sports, Justice Oliver Wendell Holmes Jr. decreed that the “personal effort” of baseball players did not fall under the definition of commerce—that is, even at the professional level, baseball could not be held to the standards of other businesses, because it was, at root, only a game. (“Of course,” Veeck quips in The Hustler’s Handbook, apropos of the 1922 ruling. “Baseball, like loan-sharking, is a humanitarian enterprise.”)

As it pertains to the potential value of pro teams as assets, the benefits of this distinction—along with the regulatory loophole it created—were manifold. In ways that were denied to proprietors operating in other businesses, it allowed MLB team owners a kind of economic safety net, and rendered traditional market concerns immaterial. Even though many more people go to restaurants than to baseball games each year, for example, your moneymaking potential as the owner of even a widely beloved burger joint will always be limited in comparison to that of the owner of an MLB team. A restaurant’s success begets competition. By government edict, a baseball team’s cannot.

Other sports leagues don’t have the explicit antitrust exemption that MLB does, which is why we occasionally see competitors—like the ABA or XFL—pop up. Though the ability to operate as if exempt from antitrust laws is something team owners in the other major sports arguably enjoy in effect. This has by and large been true since the enactment of the Sports Broadcasting Act of 1961, which rendered pro basketball, baseball, football, and hockey statutorily exempt from U.S. antitrust laws relating to the teams’ ability to collectively sell their television rights. On the one hand, this act empowered pro leagues to work on behalf of owners to negotiate the most lucrative media-rights deals possible. But as revenue from television became increasingly central to pro sports as a business model, it also served to rather comfortably insulate major pro leagues from any serious threat of competition. While it’s technically legal for an aspiring commissioner to start a competitor to the NFL, that aspirant’s chances of success are about as high as mine would be challenging Ja Morant to a dunk contest.

But team owners collaborate in ways that go beyond competition-crushing. They’re also able to work together to share revenues and cap salaries. Revenue-sharing helps ensure that every pro team, regardless of the size of their market, makes money off of things like media-rights deals. Which insulates team owners from the concerns of your typical capitalist, which relate not to competition, but changing tastes. If the formerly loyal customers of our aforementioned burger joint decide en masse that they no longer like burgers and fries, or no longer want anything to do with ketchup or mustard, there’s little recourse at the burger joint owner’s disposal other than to make potentially expensive adjustments to their menu. If formerly loyal fans of the Oakland A’s decide they’re more interested in soccer than a perennially impoverished baseball team, that’s comparatively little sweat off John Fisher’s back, because he makes most of his money (for now, at any rate) off revenue-sharing.

Collaboration designed to set salary caps, meanwhile, ensures that team owners across the board are able to pay their players—especially their stars—much less than they’d have to in a free market. Take a look at the salaries commanded by soccer players in Europe for an idea of what the absence of salary caps does to an owner’s bottom line. And to get a sense of how beneficial salary caps can be for owners, consider the NBA, where, during the 2011 lockout, owners and players signed a new collective bargaining agreement that cut player salaries by at least $240 million per year over the 10 years of the agreement.

These capacities and privileges amount, at the end of the day, to protections against competition, caprice, and cost overruns that would intrigue even the most obtuse professional investor.

3. Corporate Welfare, Commodification, and the Rise of Billionaires

Even after the Sports Broadcasting Act of 1961, however, and even after the onset of the bidding war over the right to broadcast pro sports that kicked off in its wake, team values continued to fluctuate for some time. Ultimately, pro teams did not begin to become what they are today until certain other systemic factors collaborated to create a socioeconomic environment amenable to multibillion-dollar team valuations.

The first was the introduction, in the 1980s, of Reaganomics, which cut the top income tax rate to 28 percent from 70 percent and ushered in a new age of deregulated economic growth that had the effect of expanding the market of people able and willing to buy expensive sports teams. Because the supply of pro teams available for purchase remained relatively fixed, increased demand drove up prices. As Roger Noll, economics professor at Stanford and co-editor of the essential Sports, Jobs, and Taxes, told me recently, “The driver is the limited number of teams against growing wealth.” Assuming the reasoning for investing in pro teams remains persuasive, the more billionaires there are the more competition “is going to keep driving up the price” of pro teams.

Several other important things happened in the 1980s and ’90s to drive up the price of pro teams. We can categorize these happenings into three general buckets: corporate welfare, commodification, and culture. First, the former. Team owners stand today as some of the biggest recipients of corporate welfare around. Most notably, team owners are rather routinely allowed to bully state and city governments into giving them huge public subsidies, which they often use to construct shiny new stadiums—though sometimes the subsidies serve only to further enrich team owners personally, either by funneling money directly into their pocket (in the form of “relocation fees”), or by allowing team owners to play in and profit from publicly funded stadiums without having to pay much of anything in rent.

It was not always like this. In the first half of the 20th century, team owners tended to own their stadiums outright. And for many years after that, when city and state governments finally got into the business of constructing publicly funded stadiums and leasing them out, the leases in question tended to be two-sided, in that they required team owners to actually pay rent, and directed a substantial amount of the revenues generated by the stadium not just to team owners, but to the city, as well. But then, starting roughly in the early ’90s, with the publicly funded construction of Camden Yards in Baltimore, everything changed. Intimidated by the implicit threat of the Orioles skipping town—a threat substantiated by the departure from Baltimore of the Colts in 1984—the state of Maryland extended to the Orioles, alongside the publicly funded stadium, a remarkably one-sided lease agreement. The agreement gave the team rights to a generous amount of the revenues generated by the stadium and included a “parity clause,” which entitled the Orioles to all the same perks that might be offered to whatever expansion football team Baltimore eventually lured to the city in the future. As it would happen, Baltimore got the Ravens, in 1995, in part by offering them free rent in a new stadium—which resulted, for a time, in both the Orioles and the Ravens playing in totally publicly funded stadiums for free.

Such arrangements became a new norm—much to team owners’ benefit. In nearly every instance, being on the receiving end of something like a publicly funded stadium project functions to greatly boost a team’s value. “Anytime a team gets a new stadium, you immediately see its valuation rise,” said Victor Matheson, the Holy Cross economics professor. This is due, in part, “to the extent that you can build that stadium with someone else’s money rather than have a big debt payment hanging over your team.” Take the Raiders for example. Once among the least valuable franchises in the NFL, after securing $750 million in taxpayer funding for a new stadium in Las Vegas, the Raiders catapulted from a $1.4 billion valuation in 2015 to more than $4 billion today.

Then there’s the commodification piece. Over the years, thanks in part to the rise of the internet and social media, team owners have gotten better and better at leveraging their teams to power a dynamic array of auxiliary business ventures, from merchandise to real estate, “sports operations” to startup accelerators. The more successful these auxiliary businesses, the more valuable the central brand.

4. “The Most Exclusive of Rich Guy Clubs”

Still, no pro sports team, no matter how well-leveraged—and even in the modern era—has ever generated enough revenue to justify its sales price. The economic benefits of commodification, the money to be made off media-rights deals, and the availability of corporate welfare exert far less influence over the value of any given pro team than the pretty simple fact that sports are almost singularly cool. Today, with the internet increasingly fragmenting our attention spans, they are one of the last remaining objects of entertainment monoculture we have left. This is something that audacious entrepreneurs tend to covet much more than an additional source of revenue. For many, the money to be made owning a team is of secondary importance to the sense of visibility that ownership gives you, whether that comes from sitting courtside during nationally televised games, granting interviews after nationally televised games, or waving at fans from a parade float upon the completion of a successful season. As Noll, of Stanford, told me, “Both product licensing and the broadcasting are things that give substantially enhanced visibility to being an owner of a team. And so if you’re sort of a narcissist, which a lot of these guys are, you really get a lot of value out of the fact that people like you want to interview you all the time.” The only thing that might more effectively scratch that itch these days is buying Twitter.

This is fundamental to why pro teams keep increasing in value. As Noll said, owning a pro team is sort of like owning “a street push cart that sells hot dogs [but] with a Van Gogh painting” attached to it. “You can’t explain the asset price of the push cart based purely on the hot dog.” Far more relevant to that price is the value associated with the Van Gogh. “Owning a sports team brings credibility [and] fame,” Matheson said. For a certain vainglorious sort of outlandishly rich person, such intangibles elude economic calculus. “Some of us collect comic books or baseball cards or something like that,” Matheson said. “When you’re a billionaire, you collect sports teams. That means you don’t have to value that at a reasonable amount.”

There’s one more piece of the puzzle, however. It’s not just visibility or the promise of celebrity that makes the prospect of owning a pro team so seductive. Like any luxury asset, perhaps the preeminent feature of owning a pro franchise—the real reason they confer status and prestige—is that so few people can own one. As Ringer founder Bill Simmons wrote a few years back, “Purchase an NBA franchise and you’re joining the most exclusive of rich guy clubs.” The Suns may sell for $4.5 billion and the Commanders for $7 billion not only because of their profit-generating potential, and not only because owning a team is a great way to get on TV, but because it’s unclear when another team might become available. Here again Simmons sums things up nicely:

If you pretend the NBA is an exclusive beach on Turks and Caicos, it makes more sense. Let’s say it’s the single best beach in the world, and it can only hold 30 houses. Let’s say some of the houses are bigger and prettier than others, only all of them have the same gorgeous ocean view. And let’s say all 30 owners feel strongly that their investments will keep improving. … That’s the National Basketball Association. … Who wants to be on the hottest beach? What will you pay?

The answer, increasingly over the past 40 years, has been: a lot. And that’s not likely to change anytime soon. Barring some disruption of greater societal consequence than a pandemic, cord-cutting, work stoppages, a war in Europe, or a global recession—none of which has slowed down team valuations yet—the number of people who both want and are able to buy pro teams will likely only continue to grow. In my many conversations with writers and economists for this article, I had some fun inquiring what kind of catastrophes could disrupt this trend. Some suggested a civil war, a restructuring of tax or antitrust law (which might reduce the number of billionaires), or some at-scale disaffection among fans (triggered, for example, by disgust over injuries). But even changes to U.S. tax law would affect only U.S. billionaires, and likely wouldn’t negatively affect the prices that pro teams go for. All it would mean is whoever buys the Suns or the Commanders would have to forfeit a slightly higher percentage of their wealth to do so. Because the market for pro teams is global, there is no shortage of potential buyers. “Every time I’ve thought we’ve hit a ceiling, I’ve been wrong,” Leeds said. “As long as there is some oligarch somewhere, you’re going to see people with the money and the wherewithal to buy these teams.”

Furthermore, coming innovations to the way pro sports are consumed are likely to increase their cultural relevance and revenue-generating potential even further—which will have rather predictable effects on the value of pro teams as assets. “Sports is going to be very successful [at further] integrating itself into digital services and entertainment,” Noll says. Already, “watching a game on a streaming service [is] a social media event.” Then, of course, there’s the potential profit associated with “in-play gaming.” If sports betting were ever to become legal in populous states like California, “that is going to cause the value of [teams like] the 49ers and the Rams to go through the ceiling.”

So here, then, is where we are: caught in a strange combustive symbiosis that is legally enshrined, firmly entrenched, and self-reinforcing. It’s also not totally innocuous. In Santa Clara, California, in just one example, Jed York, owner of the San Francisco 49ers, has used his family’s wealth—which is tied up in the 49ers, which are worth $5.2 billion, according to Forbes—not only to bolster the 49ers backfield but to buy up politicians amenable to his ambitions, recently sinking $3 million into Santa Clara City Council elections. As Noll, who works at nearby Stanford, told me, this isn’t really all that surprising—concentrated money is manifestly corrupting—but neither is it something we can just totally ignore. “This is part of the bigger problem of the relationship between money and politics. We have not yet figured out how to deal with that issue.”

Are rising valuations something we should worry about, then? I asked. Noll said they were, if for no other reason than what they represent, which, in the case of York’s machinations, is “the biggest threat … to the future of the U.S.,” which “is that public policy and the operation of government becomes another thing that is bought and paid for by the wealthiest people.”

Of course, it likely isn’t fair or reasonable to expect sports fans to expend too much energy worrying about the extent to which their fandom is contributing to the erosion of democracy. And so perhaps a more pertinent question is, Will rising valuations negatively affect the experience of watching and caring about pro sports? Does Jeff Bezos’s interest in the Commanders pose a similar threat to pro football, say, as his interest in online book sales poses for independent bookstores?

Maybe. Some, like The Washington Post’s Lee Ohanian, have posited that “higher price tags for sports franchises” will ultimately mean “higher ticket prices and higher cable and satellite dish bills” for consumers. (“There is a price to be paid as the value of sports franchises skyrocket,” Ohanian writes. “And unfortunately, that’s coming out of your wallet.”) That’s hardly a guarantee, however. Kurt Badenhausen, a reporter with Sportico, said to me recently that rising ticket prices are simply “a supply-and-demand issue” and have little to do with how much billionaires are willing to shell out for pro teams. In fact, he believes that the continued injection into pro sports of capital-B businesspeople who possess, presumably, more dynamic business expertise in addition to lots of money might itself usher welcome innovation to the whole of the fan experience—the price of tickets included. “I think it’s a positive,” he said.

Personally, as a lifelong fan of Bay Area sports—and of Oakland teams in particular—I’m not so convinced. In my experience, the more attention that team owners call upon themselves and their off-field interests, be they personal or economic, dynastic or political, the less engrossing and transportive the action transpiring on the field. (Also in my experience: Owners’ off-field interests tend to result in my city losing its teams entirely.) Furthermore, increasingly it seems like owners who get into pro sports for Muskian reasons of cultural relevance tend to be self-centered, to say the least. It’s telling, I think, that both Snyder and Sarver are being pressured to sell their teams due to reportedly misogynistic, racist, and overall shitty behavior.

In the end, however, all such concerns may be sort of moot. The conditions that have made it possible for a team like the Suns to potentially sell for $4.5 billion, or a team like the Commanders to flirt with a valuation of $7 billion, are unlikely to change anytime soon. They’ve become elemental to a new conception of what pro sports are. It’s hard to predict how pro sports will continue to change in the next 40 years, considering how dramatically they’ve changed in the preceding 40. (One wonders what Finley, Veeck, or, hell, von der Ahe would think of the new paradigm, wherein the value of certain pro teams exceeds the economic output of certain small countries.) But there are some things we can be sure of. Here’s one: Whenever a new record for the most amount of money ever paid for a pro sports team is set, it won’t stand for long. Depending on the market, it may be broken the very next time another pro team goes up for sale.

Dan Moore is a contributor for The Ringer, Oaklandside Magazine, and The San Francisco Chronicle. Follow him on Twitter @Dmowriter or at www.danmoorewriter.com.