“Members of the jury, here comes your intermission,” Judge Lewis Kaplan announced last Thursday, right before the case of United States v. Samuel Bankman-Fried went on a weeklong hiatus. “Enjoy!”

Since early October, members of the jury and the public, myself among them, have sat in the top floor of a Manhattan courthouse and watched the trial of Sam Bankman-Fried—the 31-year-old cryptopreneur who’s been charged with seven counts of fraud and conspiracy related to the collapse of his crypto exchange, FTX—unfold. In that time, we have listened to testimony from former investors and from forensic accountants. We have viewed Twitter DMs and Bahamian real estate porn. We have heard from an ex-girlfriend and from a fairly hostile witness—and they weren’t even the same gal! There have been giggles from the gallery and groans from His Honor; there have been phrases like “Thai prostitutes” and “Who is Shaq?” entered into the record.

During the jury selection process a few weeks back, Judge Kaplan had been a stickler about jury duty, denying people’s attempts to get out of it: He congratulated one pregnant woman but did not dismiss her; he was largely unmoved by various sob stories about weddings in Cartagena, Colombia, and business meetings that could not be skipped. But Kaplan himself also had a prior commitment—some sort of judicial conference, which I can visualize only as a bunch of berobed folks doing the limbo and/or Macarena—and so, it was time for a pause.

The trial is resuming this Thursday, with the prosecution expected to rest its well-argued case before the morning coffee break and the defense set to start offering its side immediately afterward. In a conference call on Wednesday, Bankman-Fried’s lawyers answered what had become the biggest question of the trial (bigger, in many ways, than the question of who will win): Will SBF take the stand? The answer, they confirmed, is yes. Giddy up!

Before all of that gets going, though, let’s catch up. I’ve attended the trial as often as I could the past few weeks, turning in all my electronics each morning and filling up every page of my black-and-white-marbled Mead notebook instead. Below is a roundup of the most important things I’ve learned from the eccentric characters who have been part of the trial so far.

The Storytellers: Danielle Sassoon, Nicolas Roos, et al.

Who they are: The government. The prosecution. The head-of-the-class, law review–editor types. The Feds! The kind of folks that you reeeeally don’t want to go up against: According to a Pew Research report earlier this summer, the vast majority of defendants charged with federal crimes—like, a nine-out-of-10 kind of majority—enter a plea agreement long before they ever go to trial. And the ones that do try their luck in court usually lose. (In 2022, a mere six of the 1,200 defendants in the Southern District of New York system were acquitted by a judge or jury.) After sitting in the courtroom day after day and watching the prosecution build its case, I can see why.

What we’ve learned: As a writer, I usually shy away from discussions about the art of storytelling or the craft because, quite frankly, they just stress me out. But I’ve actually found myself … creatively energized by how the prosecutors—particularly assistant U.S. attorneys Sassoon and Roos—have organized and unveiled their case. Their method has been elegant and compelling, a triumph of both keeping receipts and keeping it simple, stupid. (One former prosecutor described the streamlined strategy as “thin to win.”)

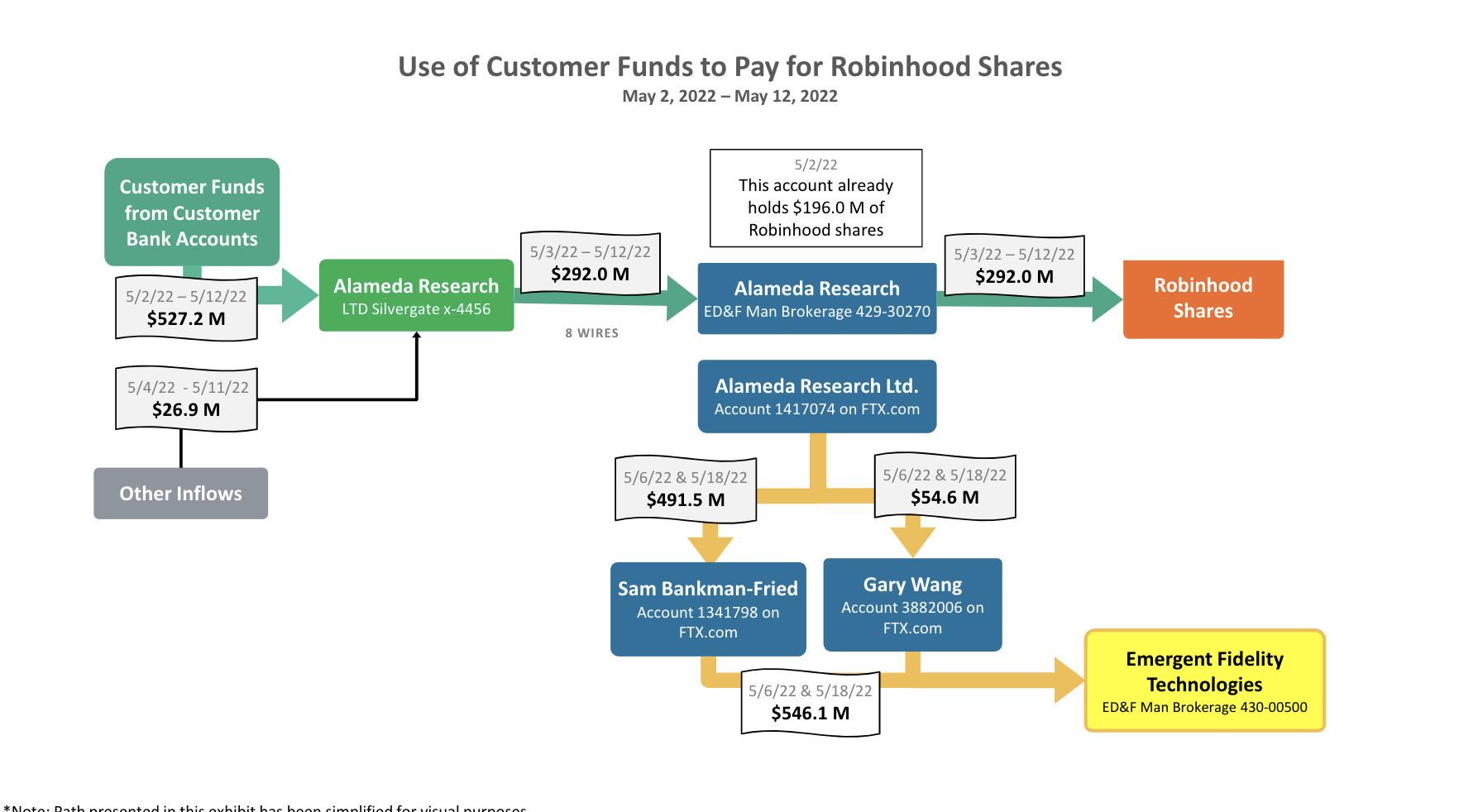

Far from getting wrapped up in confusing or sophisticated concepts like the blockchain or Tether, the government has made it clear that the crimes Bankman-Fried is accused of are actually pretty typical: taking money that doesn’t belong to you, spending it on whatever you feel like, and then lying to cover up what’s gone. They’ve also managed to sift through what could be a confusing vortex of entities with names like “Paper Bird” and “North Dimension” via a sort of Chekhov’s subaccount strategy: If you hear the words “Emergent Fidelity Technologies” in the first act, you can bet they’ll show back up later to cause drama and inflict harm. And the prosecution has, to great effect, paired witnesses with multimedia: The highlight of the testimony of former FTX lawyer Can Sun wasn’t necessarily his recollections, but rather a brutal Good Morning America clip of Bankman-Fried that was entered into evidence.

Memorable phrase: Throughout the trial, the prosecution has made sure that the phrase “FTX customer funds” is used again and again and again, a reminder of who the victims are here.

The Big Three: Gary Wang, Caroline Ellison, and Nishad Singh

Who they are: Three of Bankman-Fried’s closest associates, professionally and personally, all of whom signed cooperation agreements with the government over the winter and have pleaded guilty to sets of charges similar to the ones Bankman-Fried is being tried for. They will be sentenced once the trial has reached its conclusion, and their testimony has been vital for the prosecution. (I wrote about Ellison at length here.)

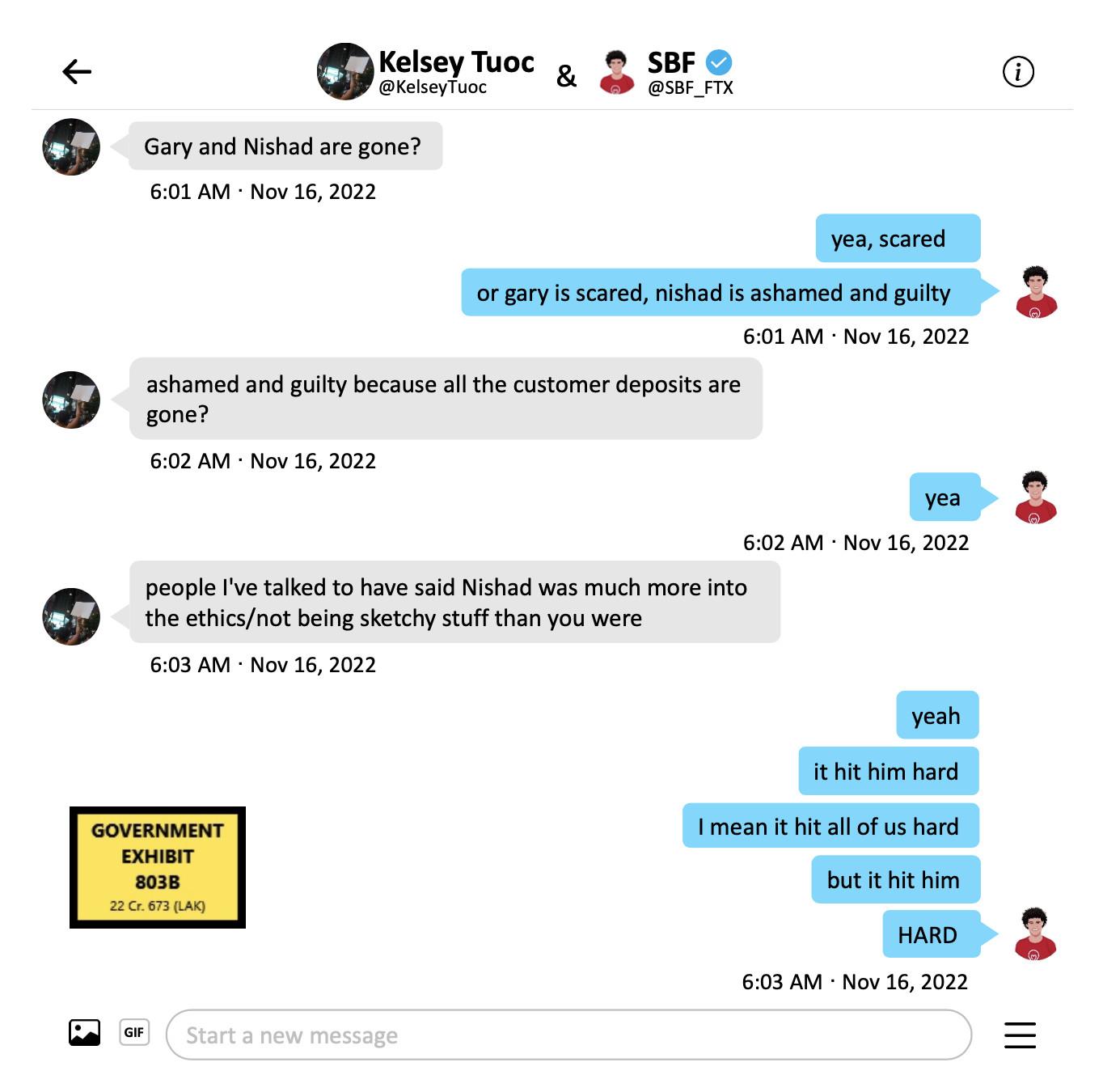

What we’ve learned: While each person’s testimony was telling on its own, together, they added up to even more than the sum of their parts. Sam’s former associates have really different demeanors and personalities, all of which came through on the stand: Wang is a reserved, leave-me-alone engineer who had a sweet spot on the company org chart; Ellison is a bubbly LARPer who was dealing with a big promotion and some unrequited love; and Singh is an overworked family friend with huuuuge emotions. And yet they all had the same problem and the same answer: Sam. Seeing the distinct ways each of them became conspirators in the misappropriation of FTX customer money and the misreporting of balance-sheet assets helped paint a clearer picture of the man at the heart of it all.

Memorable phrases: There were a number that stuck out from the testimonies of these three. Ellison alone uttered the words “Thai prostitutes,” “Saudi prince,” and “a large bribe to Chinese government officials” at various points in her remarks. (Sassoon’s deadpan “Let’s break that down a bit” after that last one drew more than a few grins.)

Wang spoke repeatedly of “Allow Negative,” a code toggle that he said enabled Bankman-Fried’s trading firm, Alameda Research, to have unfettered access to FTX customer funds. “If ‘Allow Negative’ is checked,” Wang explained, “that means that you are allowed to withdraw more than what you have in the account.” Must be nice!

But perhaps the most lasting impression came not from a few words, but from a photo worth a thousand of them. As Singh described a stressful one-on-one “evening-into-night” meeting he had with Bankman-Fried on the balcony of one of the FTX properties in the Bahamas, the prosecution threw an exhibit up on the screen: not just the balcony in question, but the balcony at the same time of night as the meeting. “I was pacing behind where those baskets on the left are,” Singh said. “Sam was reclined on one of the white, like, chaise chairs.” The panic! The excess! The dusky hues! It’s an image that will forever be burned in my brain. Turns out the prosecutors aren’t just good writers; they’re excellent cinematographers, too.

The Pleasure of the Court: Judge Lewis A. Kaplan

Who he is: I’ve written about Judge Kaplan’s background before, but what has stuck out most to me over the past few weeks is the extent to which he is always firmly in the foreground of the trial. Sometimes wry, always restless, Kaplan, 78, oscillates between tossing Silent Generation zingers and exasperated daggers. He follows a reprimand with a chuckle at his own joke; he sometimes has the annoyed air of a late-afternoon-in-February Mike Francesa. (Complaining on a Wednesday morning conference call about the volume of paperwork that’s been submitted by both sides this week, Kaplan fretted about “the deforestation of America.”) He asks legitimately useful questions on behalf of the jury, to whom he speaks in grandfatherly tones. This all might have felt like a different trial if the first judge assigned hadn’t recused herself because her husband’s law firm previously advised FTX.

What we’ve learned: That Kaplan likes his tuneage, as evidenced by this exchange with defense attorneys Christian Everdell and Mark Cohen:

The Court: Slower. I can’t take it this fast.

Mr. Everdell: I will slow down.

The Court: I listen to 33 RPM records, not 45.

Mr. Everdell: I’ll slow it way down, your Honor. My apologies.

The Court: Nobody listens to records.

Mr. Cohen: I may be the only one who remembers 33, your Honor.

The Court: You may remember 78s. We both do.

Mr. Everdell: I hate to swear yet again, but I will do it slower this time. “A month ago CZ was a walking example of ‘don’t do unethical shit or your money is worthless.’”

The Court: We are talking about the guy from Binance.

Mr. Everdell: That’s correct, your Honor.

Memorable exchange: While the judge has reserved most of his displeasure for the defense counsel, largely for repeating questions that have already been asked and answered and for requesting frequent sidebars, he is an equal-opportunity witherer. To wit, this utterly Shanahanian conversation with a prosecutor, which has now entered my household lexicon:

The Court: Why don’t you ask him that?

Ms. Kudla: I am getting to that point. It will only take about 10 minutes.

The Court: Some people don’t have 10 minutes left to live.

Ms. Kudla: Fair.

The Elephants in the Room: SBF’s Mom and Dad

Who they are: Joseph Bankman and Barbara Fried are slight in stature, but their presences loom large in the courthouse each day. It’s impossible for me not to constantly think about what they must be thinking. Not only are they watching their son stand trial for crimes that could put him in prison for decades … they’re also seeing their other son’s best friend, Nishad Singh, up on the stand. (In Michael Lewis’s book Going Infinite, Nishad is quoted as saying that when he was a teen, the Bankman-Frieds “were the first grown-ups who took me seriously, and it made me take myself seriously.”) Not only are they watching their son’s very expensive defense attorneys get routinely upbraided by the judge … they’re also embroiled in their own financial messes that occasionally show up in evidence. Not only are they being stared at by people like me all day, every day … they also have to cross paths with us in the bathrooms and elevators and hallways. It’s an odd scene.

What we’ve learned: That each unhappy family is unhappy in its own way.

Memorable phrases: “Small Group Chat” (the Signal group created during the FTX meltdown that included, among others, SBF’s dad) and “Mind the Gap” (the political action committee helmed by SBF’s mom, which has come up several times as the destination of monetary flows).

The Money-Follower: Peter Easton

Who he is: CoinDesk dubbed this expert witness “Finance Santa Claus,” adding, “His testimony was tantamount to beating Bankman-Fried with a sock full of coal.” To me, between his slight Aussie accent, his solemn and sure-of-himself demeanor, and his thick, white beard, Easton seemed most like a long-lost brother of Logan and Ewan Roy who relocated Down Under.

What we’ve learned: The day I heard that a forensic accountant would be testifying, I chugged an extra Celsius before I entered the court: Sometimes, a morning full of numbers starts to have the same effect as counting sheep. But between the groundwork that had already been laid by the prosecution and Easton’s clear, declarative presentation about movements of money into and out of customer and personal accounts, this might have been one of the trial’s most interesting witnesses. He presented easy-to-follow flow charts and tossed in some knife-twisting for good measure—when Easton pulled up one $16 million outflow for a Bahamian condo that had SBF’s parents’ names attached, Barbara Fried visibly recoiled.

Memorable phrase: “Enron, WorldCom, and Parmalat”—Easton’s list of some of the other cases he’s done forensic analysis for. A rogues’ gallery indeed.

The Princess of Darkness: Eliora Katz

Who she is: A onetime lobbyist for FTX who absolutely did not want to be testifying and made sure we all knew it. The closest thing the prosecution had to a hostile witness, and how! Wearing a black bouclé suit that looked like it was maybe Chanel and speaking with a combination of Daria’s apathy and Aubrey Plaza’s hostility, Katz testified, kind of, about Bankman-Fried’s Washingtonian ambitions and about some of the trips he took to speak with or in front of congressional representatives. It was an eye-rolling (for her), riveting (to me) appearance indeed.

What we’ve learned: The high-key awkwardness of Katz’s testimony did, ultimately, have a point: The prosecution used her presence to introduce into the record some pretty damning videos in which Bankman-Fried testified before Congress about the importance of regulation and protection of customer accounts.

Memorable phrase: Katz never missed an opportunity to remind the world that she had come to FTX only in April 2022. I counted at least 10 uses of the phrase “long before I joined FTX” or similar, the best of which was: “Again, this tweet [was] tweeted before I joined the company.” We stan a responsibility-shedding queen.

The Ping King and the SocMed Fed: Richard Busick and Shamel Medrano

Who they are: Both of these witnesses were present to speak to nitty-gritty stuff like cellphone pings (to place SBF in Manhattan frequently and help establish SDNY’s jurisdiction over the case) and how Twitter works. (Yes, that day’s testimony included subjects like: What is a retweet? It was great.) But thanks to the prosecution’s preparation, Busick’s and Medrano’s testimony spoke volumes beyond that.

What we’ve learned: The various pieces of evidence about cellphone pings, on their own, would have been dry as hell if it weren’t for the little flourishes that accompanied each one: emails from Sam’s personal scheduler, Natalie, about scheduling various NYC meetings up and up the hierarchy. A meeting with the mayor of New York; with the governor of the state; with former president Bill Clinton! On and on it went, each one linked to a ping. (The funniest of them all: an email from the prime minister of the Bahamas, who asked if Bankman-Fried would meet with his kid about some NFT project, which the prosecution used to establish that they had the right cellphone number for Bankman-Fried.)

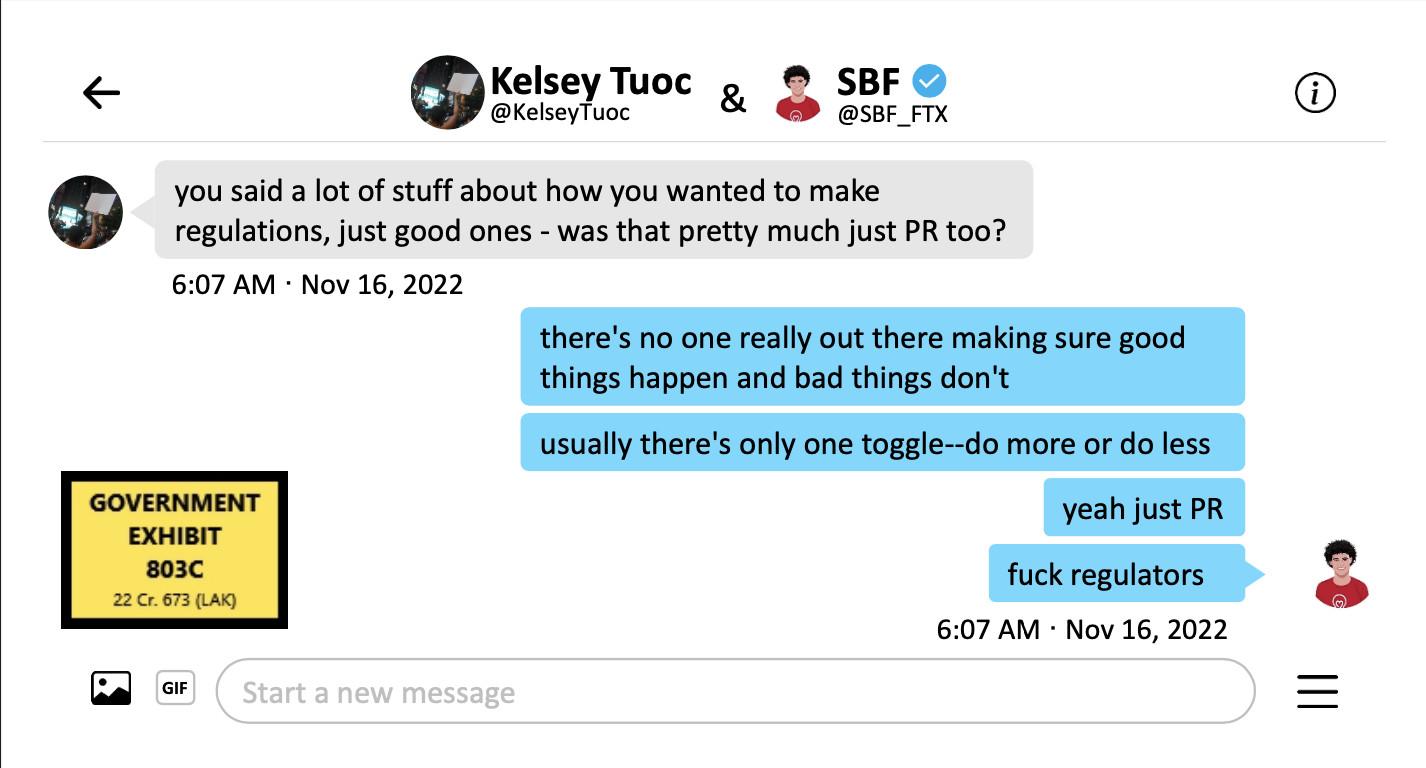

As for the Twitter material, it was all essentially there to build up to one big reveal: the explosive DM exchange that Bankman-Fried had with Vox writer Kelsey Piper in between the fall of FTX and his arrest, one that had some jurors furrowing their brows and others raising them.

Memorable phrase: Honestly, everything in Sam’s DMs with Piper—which he claimed to not realize were on the record. But “fuck regulators” is really the crème de la crème of things you don’t want the jury to see when they’re deciding your fate in a financial fraud case, you know?

The Overruled: Mark Cohen, Christian Everdell, et al.

Who they are: Gluttons for punishment, apparently! Look, Bankman-Fried’s defense counselors—some of whom used to be federal prosecutors themselves—have a really, really tall task at hand. Their client is surrounded by people who flipped on him. He had a penchant for putting things in writing, despite his exhortations to friends and staff about never putting something in writing that you wouldn’t want to see on the front page of The New York Times. He managed to screw up a cushy house arrest in Palo Alto and got sent to jail before the trial even began. He even wants to testify! I would feel bad for them, but then I remember that this is what the money is for.

What we’ve learned: You mean besides the fact that Christian Everdell looks like he could be the brother of Steve from Sex and the City, a thought that distracts me every day? OK, to be fair, I have learned a few things from the defense team. While their cross-examination of Ellison was a dud, their cross of Singh was much more successful, highlighting some of his shiftier moves—like overcoming his moral qualms to buy a house with illicit funds—and calling out his selective memory. While it didn’t rise to the level of discrediting, it was the kind of effective chipping away at the witness that I had expected more of throughout.

Memorable phrases: Each of the defense lawyers has gotten rekt enough over the course of the past few weeks—by the judge, by opposing counsel, even by a witness or two—that I’ve started recognizing their backpedaling tics. Cohen’s is “fair enough, fair enough,” Everdell’s is “ah, well” (missing only that sweet, sweet “nevertheless”), and David Lisner came through the other day with a new one: “[long pause] Got it, got it.”

Not to Be Messed With: The Court Marshals

Who they are: The officers responsible for keeping order in the court, one of whom could absolutely be played by Robert De Niro in Martin Scorsese’s next film. In addition to all their other duties, these marshals memorize every face that enters the courtroom and do an incredible job of enforcing “same seats” after the lunch break. (Have you ever seen the video of the machine that sorts out unripe tomatoes? The process basically looks just like that.)

What we’ve learned: To shut the hell up! Last Wednesday, the marshal on duty (not De Niro—this guy is more of a Jon Bernthal) threatened a whole bunch of us in the gallery with banishment from the courtroom for a multitude of offenses, ranging from chewing gum to whispering to having the day’s newspaper in hand. I haven’t been (deservedly!) scolded like that since I was a teenager, and I’ve been silent and straight-spined ever since.

Memorable phrase: [a menacing glower]

The Man Himself: Sam Bankman-Fried

Who he is: The accused. The defendant. The three initials at the center of it all. “In a lot of ways I don’t really have a soul,” Bankman-Fried once wrote to Ellison, according to Going Infinite. “This is a lot more obvious in some contexts than others. But in the end there’s a pretty decent argument that my empathy is fake, my feelings are fake, my facial reactions are fake.” By the end of this week, all eyes will be on Bankman-Fried as he approaches the stand and swears to tell nothing but the … truth?

What we’ve learned and memorable phrase: With Bankman-Fried about to take the stand, we sure are about to find out. More to come, so long as I don’t get kicked out of court for doing the crossword.