Trade season has unofficially begun in the NBA. As of December 15, most players who were signed last summer can be dealt, which greatly widens the pool of available trade targets. And while the deadline itself isn’t until February 6, consequential trades can arrive much earlier than that: The Knicks acquired OG Anunoby last December 30, and the Warriors got the party started even quicker this season when they nabbed Dennis Schröder from the Nets on Sunday.

Schröder should help the Warriors’ lack of playmaking around Steph Curry, though he’s not a panacea for all of Golden State’s recent problems. But his trade is just the tip of the iceberg—both for the Warriors and the rest of the NBA. Let’s look at what to expect over the next two months in today’s Kram Session, a regular Ringer column throughout the NBA season into which we’ll stuff as much analysis as possible.

Under Review: Big Men Without a Market

If you haven’t paid attention to Nikola Vucevic’s resurgence this season, you’ve missed out. Vooch has been incredible through 25 games, averaging 21 points (his most since joining the Bulls) and making 64 percent of his 2-pointers and 47 percent of his 3s, both career highs. It’s an unlikely late-career renaissance from a player who has never made an All-NBA team, is infamous for headlining a terrible trade, and seemed to be in decline after suffering through a season-long shooting slump in 2023-24.

Now, the 34-year-old center ranks near the top of several offensive leaderboards. Basketball Reference tracks a fun statistic called “TS added.” It takes into account free throws, 2-pointers, and 3-pointers to determine overall scoring efficiency (that’s the “TS,” or true shooting, part) and compares a player’s actual point total to how many points a league-average player would be expected to score given the same number of attempts (that’s the “added” part—whether the player in question adds or subtracts points versus expectation).

The top of the TS-added leaderboard tends to be filled with MVP candidates, which makes sense because this stat rewards high efficiency on high volume. This season is no exception: Domantas Sabonis is in first place, Nikola Jokic is third, Giannis Antetokounmpo is fourth, and Karl-Anthony Towns and Shai Gilgeous-Alexander are in the top 10. And in second place in TS added, one spot ahead of Jokic, is the unexpected Nikola playing for the Bulls.

Vucevic’s scorching start is relevant to the trade deadline because the Bulls would love to lose him as they forge a future-oriented path. Over the summer, the perennial participants in the East’s 9-10 play-in game traded Alex Caruso and let DeMar DeRozan leave via a sign-and-trade. Currently in ninth once again, the Bulls are now incentivized to shed more veteran contributors because they owe a 2025 top-10-protected pick to the Spurs.

But despite his sterling stats, and despite—or maybe because of—the Bulls’ reported desire for a first-round pick in exchange, there appears to be little leaguewide appetite for Vucevic. The Stein Line’s Jake Fischer said last week that a source told him he’s “crazy” if he thinks the Bulls could fetch even multiple second-round picks for Vucevic, and ESPN’s Tim Bontemps wrote that “sources across the league also don’t expect much interest in trading for him.”

Vucevic is one of a number of centers available for trade over the next two months who might not receive as much interest as their performances or reputations might suggest. In addition to Vucevic, there’s also Jonas Valanciunas, who seemed like obvious trade bait as soon as the Wizards signed him over the summer. Valanciunas is still beasting opponents inside—his averages of 22 points and 14 rebounds per 36 minutes place him in elite statistical company with Jokic, Towns, Sabonis, and Alperen Sengun.

Want a younger center instead? Robert Williams III, a 27-year-old defensive whiz who’s played well this season when healthy, is available. So is Trail Blazers teammate Deandre Ayton, a former no. 1 pick who is just 26 years old and has averaged a double-double every season of his career.

The problem is that the supply of competent centers far outstrips the demand. The replacement level for centers is higher than for any other position, and almost every rotation has at least a decent center or two nowadays. Why trade a haul for another team’s center when he’s not much more effective than the ones already in-house?

As we survey the trade market, let’s ignore the six teams with almost no chance to make the playoffs (the Wizards, Hornets, Raptors, Jazz, Pelicans, and Trail Blazers), as well as two more Eastern teams (the Nets and Vucevic’s Bulls) that will be heavily incentivized to lose down the stretch. That leaves 22 teams theoretically positioned to chase 2024-25 roster upgrades.

But of those 22 prospective trade partners, 17 already have established centers who rank among the top 100 players in the NBA: the Nuggets, Bucks, Lakers, Spurs, Kings, Knicks, 76ers, Cavaliers, Heat, Thunder, Rockets, Grizzlies, Celtics, Timberwolves, Clippers, Pacers, and Mavericks. With possibly an exception or two that we’ll discuss momentarily, those teams don’t need another center.

That leaves five teams that are both loosely competitive and lacking a top-100 big man. But even they might not be clamoring for an upgrade at the 5. The Warriors seek a star wing, and they typically close games with small-ball, no-center lineups anyway. For Atlanta, Clint Capela is solid enough, and backup Onyeka Okongwu—rather than an import via trade—is the obvious replacement if Hawks brass decides to make a change. The Pistons could try to boost a play-in push against a soft Eastern Conference field, and their top two centers—Jalen Duren and Isaiah Stewart—have both regressed this season, but they might still be a year away from making any win-now moves.

Orlando could be a center destination because Wendell Carter Jr. has plateaued and the Magic are competitive for a top-four seed. But behind Carter, Orlando already has Goga Bitadze and Moe Wagner, who have quietly developed into two of the best depth bigs in the NBA. If they decide to add at the deadline, the Magic should probably prioritize another perimeter playmaker.

The final prospective buyer to consider is the Suns, who have the most urgent need for an upgrade at the center position. But logistics hinder Phoenix’s options, as the Suns are above the second apron and have almost no draft capital left to trade.

Compounding this contextual problem is that center isn’t like other positions in the NBA. On the perimeter, positions are fungible enough that basically every contender would gladly add another useful guard or wing; it’s easy to shift a small forward to shooting guard or power forward depending on his teammates. But a new center is a harder fit; making a two-big lineup work is tricky, and only particular centers with particular skill sets can pull off the Twin Towers approach in the modern game.

Unfortunately, the centers currently available for trade are all limited in some way or another. Both Vucevic and Valanciunas are extremely permissive defenders; Vooch is allowing opponents to shoot 70 percent at the rim this season, the second-worst mark for a high-volume center, while Valanciunas has allowed 67 percent or worse four seasons in a row. Neither big is quick enough to defend on the perimeter if he were paired with another center with superior rim-protection skills. Estimated plus-minus grades Valanciunas as a below-average player overall and Vucevic as only slightly above average despite his offensive strength because he gives back almost all of that advantage on the other end.

Meanwhile, Ayton’s development has gone sideways in recent seasons, and his hefty salary—$34 million this season and $35.6 million for 2025-26—makes him unlikely to move. And it would be difficult for a contender to invest in Williams, given his struggles to stay on the court.

The result is a stagnant, shallow trade market for centers—even though these bigs can still help teams. They’re playing well!

Chicago coach Billy Donovan told me that the Bulls’ league-leading pace has helped Vucevic, which might run counter to his reputation as a plodding, post-up center now in his mid-30s. But Vucevic can run well for his size, and he’s “incredibly professional about taking care of himself and his body,” Donovan said. So when Vucevic has caught the ball as the trailing big at the top of the key, “he’s been really good shooting it, he’s been good distributing it to the second side, or he’s been really good against closeouts, putting it on the floor and creating the next action.”

That skill set makes Vucevic sound like a strong fit for the Warriors, among other teams. The Grizzlies and Pacers—who traded for Thomas Bryant last week but might need another big man because of injuries behind Myles Turner—also play with great pace, and the Lakers ranked fourth in pace last season but are just 20th under new coach JJ Redick this year. Los Angeles needs another big with Jaxson Hayes and Christian Wood hurt, and Anthony Davis might be such a dominant defender that he can cover for Vucevic’s weaknesses on that end.

Perhaps the most intriguing trade possibilities for a center involve Williams, whose lack of shooting range means he’s best deployed with a stretch 5 in a two-big lineup, as he was with Al Horford in Boston. Williams could fit on the Knicks, given Towns’s positional flexibility—though New York, like Phoenix, is limited in its trade options by both money and available draft picks. Memphis is another enticing trade partner because Jaren Jackson Jr. can stretch the floor, and a Williams-JJJ pairing would wreak defensive havoc. But the Grizzlies have a lot invested in rookie center Zach Edey, and even with Edey injured, they have a workable big man rotation featuring JJJ, Brandon Clarke, Santi Aldama, and Jay Huff.

Such is the difficulty with using the trade machine for bigs heading into this season’s deadline: Unless a contender’s starting center suffers a season-ending injury, there’s no obvious fit for anyone on the market. Solid, available bigs might not be traded, or, if they are, they’ll likely fetch a less lucrative return. In the words of famed ball-knower William Butler Yeats: Trades fall apart; the center position cannot hold.

Hardwood History: The Heat Are Known for Acquiring Stars. Have They Ever Traded One Away?

The biggest player who could be on the move at this deadline is one of those centers. But the biggest name is Jimmy Butler, the six-time All-Star and playoff hero who might be on his way out after six years in Miami.

Miami is “open to listening to offers for Butler and making a deal if the proposal is right,” ESPN’s Shams Charania reported last week, noting that Butler can opt out of his contract and become a free agent next summer. Charania listed Dallas, Houston, Golden State, and Phoenix as Butler’s preferred destinations. (Unless Bradley Beal consents to being traded, the Suns can’t possibly trade for Butler given their CBA limitations, and I have no idea how the Mavericks would realistically manage to match Butler’s $48.8 million salary either, unless they included Kyrie Irving in the deal or sacrificed all of their frontcourt depth.)

But Miami has a reputation for acquiring stars, not sending them away. The Heat have had 10 All-Stars in their history. Here’s how those players’ Miami tenures ended:

- Still on the team: two (Butler, Bam Adebayo)

- Retired/waived due to injury: one (Chris Bosh)

- Left in free agency: four (Dwyane Wade, LeBron James, Alonzo Mourning, Anthony Mason)

- Traded years after All-Star peak: two (Goran Dragic, Tim Hardaway)

- Traded while still an All-Star: one (Shaquille O’Neal)

In other words, the Heat have traded a current star just once in their 37-year history as a franchise. On the surface, there are similarities between that instance and now. Like Butler, Shaq initially arrived in Miami via a steal of a trade. Like Butler, Shaq helped lead Miami to great playoff success (in Shaq’s case, one title, versus Butler’s two Finals appearances). Like Butler is now, Shaq was 35 years old when Miami decided he’d lost a step and was ripe to be dealt.

But there are, of course, key differences between the two situations. Butler is in better shape at 35 than Shaq was, and his quality of play hasn’t declined as much as Shaq’s did after Miami’s 2006 title. Miami was terrible when it traded O’Neal—a league-worst 9-37 at the time—while the present-day Heat are still at least fringe competitors, with a four-game winning streak propelling them to a 13-10 record and fifth place in the East. And trading Shaq didn’t reset the Heat’s identity—they still revolved around Wade—to the same extent that trading Butler would mean turning a page on the latest iteration of the franchise.

So the Heat-Butler breakup might come, but it would be a nearly unprecedented move for Miami to deal its star.

Zacht of the Week: Championship-Altering Deadline Trades Are on the Rise

Back in 2018, I called on NBA history to pour cold water on the idea that deadline trades matter for the championship race. “Just 15 percent of finalists in the past 30 years (nine of 60) have added a player on an in-season trade who played in at least 20 minutes per playoff game,” I wrote, adding that “only four times in the past 30 years has the eventual champion added an impact player via midseason trade.”

Here’s the list of those nine trading finalists and the players they added, with the champions in bold:

- 2015 Cavaliers: Timofey Mozgov, Iman Shumpert, J.R. Smith

- 2009 Magic: Rafer Alston

- 2008 Lakers: Pau Gasol

- 2005 Spurs: Nazr Mohammed

- 2004 Pistons: Rasheed Wallace

- 2001 76ers: Dikembe Mutombo

- 1995 Rockets: Clyde Drexler

- 1994 Knicks: Derek Harper

- 1989 Pistons: Mark Aguirre

But today, I’m here to criticize my past self for a lack of foresight. Because now there’s a new trend that runs counter to the historical pattern. In seven seasons since I wrote that piece, six finalists have added a 20-minutes-per-game rotation player at the deadline, a much higher rate than before:

- 2024 Mavericks: P.J. Washington, Daniel Gafford

- 2022 Celtics: Derrick White

- 2021 Bucks: P.J. Tucker

- 2020 Heat: Jae Crowder

- 2019 Raptors: Marc Gasol

- 2018 Cavaliers: George Hill

Now, most champions still don’t rely on deadline deals; the 2024 Celtics, 2023 Nuggets, and 2022 Warriors already had their rotations set and had no need for midseason additions. But in the current era of rapid player movement and aberrant championship parity, it’s more likely that a role player added at the deadline can serve as a fringe contender’s clichéd missing piece and push his new team over the top.

A Graph Is Worth a Thousand Words

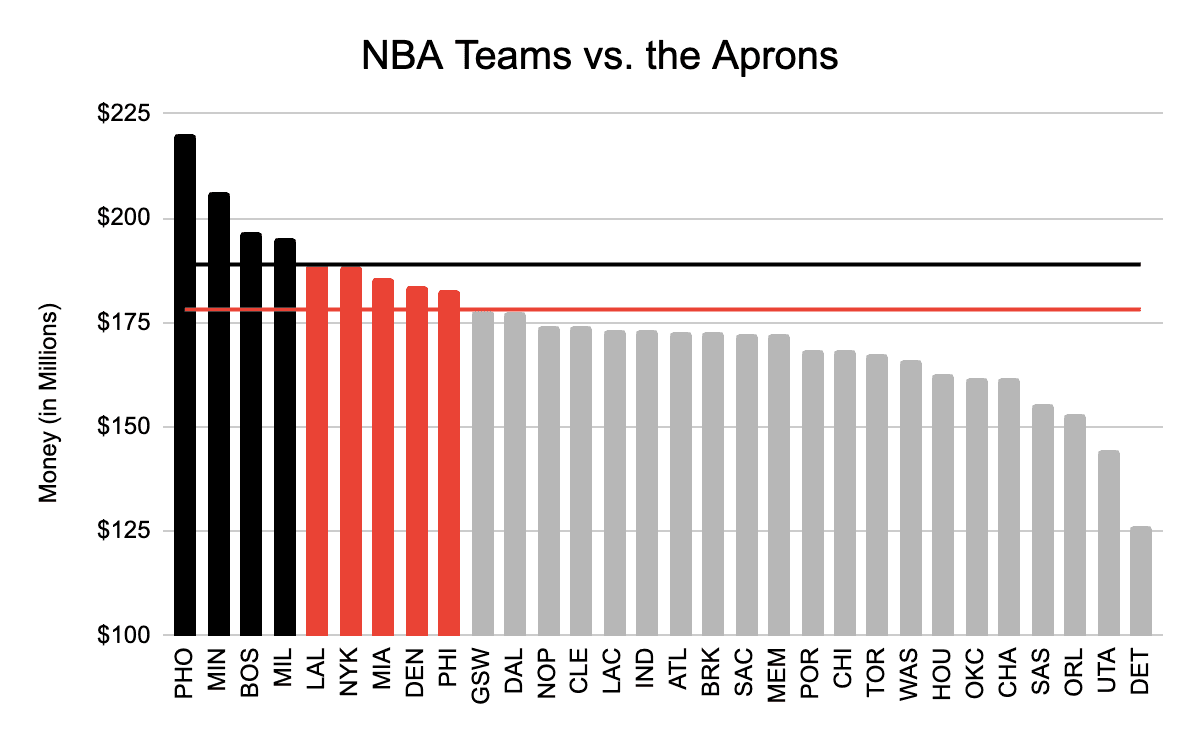

Frankly, the NBA’s new era of enhanced cap complexity needs more than 1,000 words to explain. But this graph can help display which teams are most affected at this deadline: The black bars represent teams above the second apron, the red bars represent teams above the first apron (but not the second), and the gray bars represent teams below both aprons.

Nine contenders are above at least the first apron, and the Warriors and Mavericks are both within $1 million of the first line. Among other restrictions, teams above the first apron can’t take back more money in a trade than they send out and are limited in the buyout market, while teams above the second apron can’t combine multiple players’ salaries to match a trade target’s salary. For instance, even though Jusuf Nurkic and Ryan Dunn make more money together than Vucevic, the second-apron Suns are barred from trading Nurkic and Dunn for Vucevic.

Fast Breaks: Four Sellers to Watch

1. New Orleans Pelicans

The Pelicans are toast thanks to their injury-riddled start to the season. The Pels were expected to contend for a playoff spot, but a Western Conference–worst 5-22 record places them in prime capture-the-Flagg range instead. This lost season doesn’t mean New Orleans has to engage in a big sell-off, though: During their own lost season in 2023-24, the Grizzlies kept their entire core together and shuffled around only spare parts, and now they’re in second place in the West.

Brandon Ingram’s a free agent after this season, so the Pelicans should try to deal him if he’s healthy by February, lest they lose him for nothing this summer. But every other key Pelican is signed for at least another season, if not longer, so while the likes of Herb Jones might be available and attractive to contenders, the team could try to run it back, and hope for better health, in 2025-26.

2. Chicago Bulls

The Bulls’ main trade chips are Vucevic and Zach LaVine, but Lonzo Ball—a free agent after this season—lurks as another potential target. Health will always be a concern with Ball, who is back on the court for the first time since January 2022 and hasn’t topped 22 minutes in a game this season. But when he takes the court, Ball remains an incredibly disruptive defender (he’s one of 12 players this season averaging at least two steals and a block per 36 minutes) and a canny creator (he leads those 12 players in assists per 36 minutes).

3. Brooklyn Nets

The Nets didn’t trade to get their 2025 first-round pick back so they could compete for a play-in spot. They want better lottery odds! And with a number of useful players with reasonable salaries ($13 million for the now-departed Schröder; $14.9 million for Dorian Finney-Smith; $22.5 million for Cam Johnson; heck, even $4 million for Cam Thomas, a restricted free agent after this season), there might be a Brooklyn exodus over the next two months. Johnson in particular intrigues, with the 28-year-old wing averaging 19 points on 43 percent shooting from 3 in a career year. If Butler stays in Miami and LaVine in Chicago, Johnson might be the best player to change teams at this deadline.

4. San Antonio Spurs

I’ll end with one trade proposal from a potential seller that hasn’t been discussed much leading into trade season: the Spurs, who are 13-13 and straddling the line between pushing for a play-in spot in Victor Wembanyama’s second season and biding their time because they’re not quite ready yet. Might the Spurs trade Harrison Barnes to Dallas for a pick or two?

The Mavericks are legitimate title contenders, but they could use another big wing behind P.J. Washington, whom they acquired at last year’s deadline. Maxi Kleber has clearly lost a few steps and is averaging a meager 1.7 points per game, and Kleber plus third-string center Dwight Powell plus injured guard Dante Exum add up to a nearly perfect match for Barnes’s salary. Barnes doesn’t need the ball much—his usage rate is at a career low in San Antonio—but he can still be effective when called upon, with a 43 percent 3-point stroke this season and a recent Player of the Week award on his mantel. And Barnes-to-Dallas would be a pleasant homecoming for the former Maverick after his awkward departure via an in-season trade six seasons ago.

Stats current through Saturday’s games.