Here’s how it works. You want to buy a thing. Let’s say you want to buy a suit of plate mail armor. Let’s say your favorite plate mail armor is made in Slovenia. You browse the website of the finest armor shop in the world—Wally’s Discount Shield Shack, in downtown Ljubljana—and order up a set. It costs $3,000. Wally packs up your armor himself and ships it to your house in North Dakota. Wally uses DHL, and DHL does a great job, so the package gets to the U.S. in just a couple of days. But then it gets stuck in customs. DHL says it can’t deliver your armor to your house until you pay an extra fee to the government—in this case 8 percent, which, let’s say, is the legally mandated import duty on medieval jousting gear. Until you cough up an extra $240, your suit of armor is going to sit in a warehouse in New Jersey. Your vulnerable kidneys will be unprotected against any and all crossbow or halberd attacks.

This is how import fees, such as the sweeping regime of tariffs that Donald Trump unveiled during his “Liberation Day” speech on April 2, raise revenue for the government. A tariff isn’t exactly the same thing as an import duty, but they work in essentially the same way. You import something from abroad, it gets stopped on the way in, and you pay the tax so that you can get it. The amount of the tax depends on what you’re importing and where it’s from, but the tax applies whether you’re just some guy bringing in a suit of armor or a trillion-dollar corporation bringing in shipping containers full of a product you plan on reselling here. Multiply your armor problem by millions, and you’re Apple bringing iPhones from China to the United States.

So here’s the most immediate impact of Trump’s new tariffs. They massively increase the amount you have to pay to import most things into the United States. I think many people aren't understanding this, in part because the media tends to talk about tariffs as if they’re levied on foreign countries directly—“China Will Face at Least 54 Percent Tariffs With Trump’s New Order,” as one recent New York Times headline put it. This is misleading language because it suggests that China is paying America money to sell its goods here. That’s not how it works. China doesn’t pay a cent. Americans do all the paying. Imagine going to the store and finding out that the sales tax had been bumped from 5 percent to 54 percent. That’s what the Trump tariffs are doing.

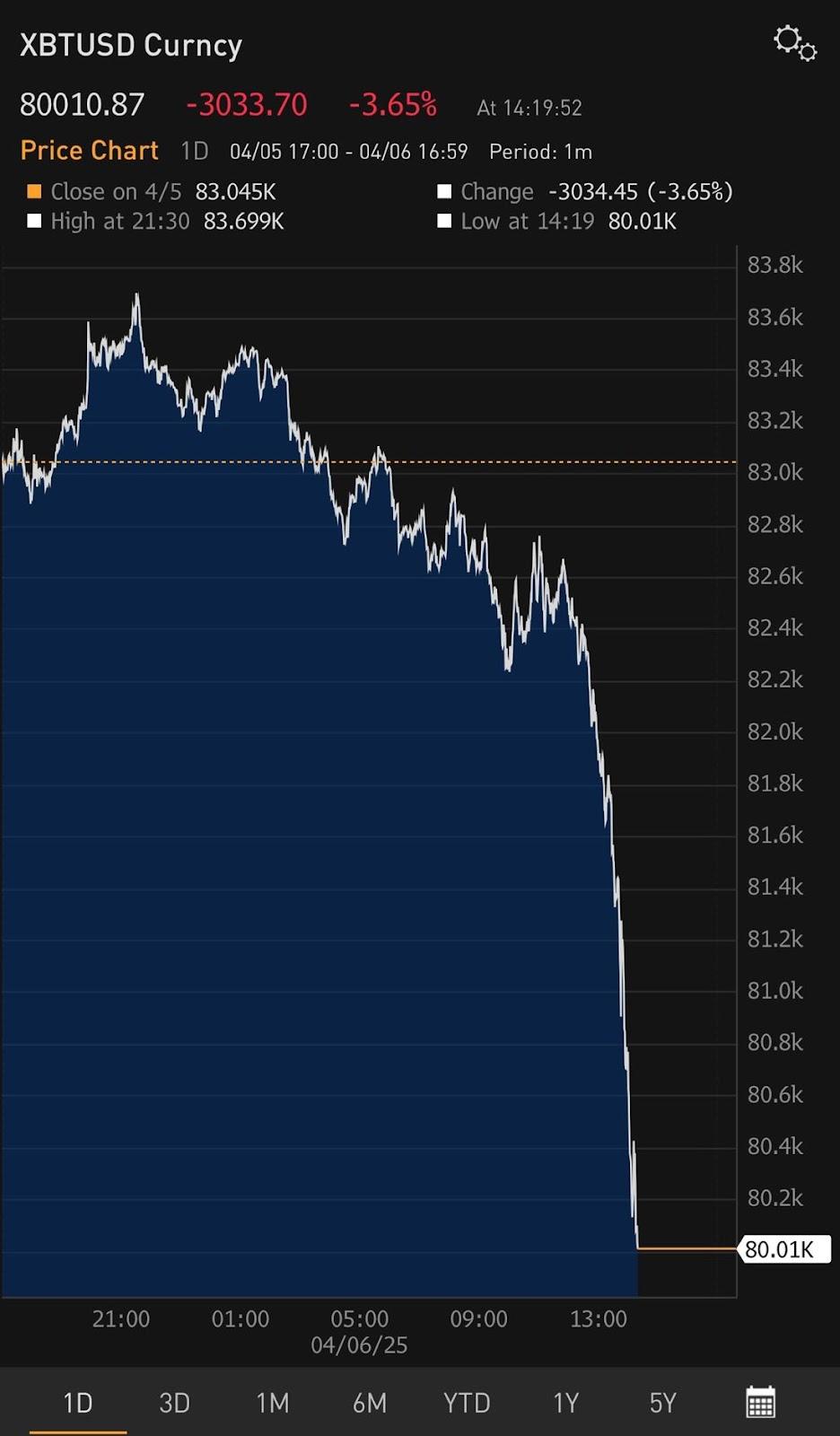

This is why the stock market is in chaos. This is why $5 trillion in equity wealth evaporated in two business days after the tariff announcement. Not because the government of China is suddenly being forced to surrender huge sums to the government of the United States, but because American companies and consumers are being forced to do so. Stocks go down when people buy less stuff, people buy less stuff when prices go up, and prices go up when goods are more expensive to make or to sell. The stock market is often the wrong economic indicator to worry about if you care about regular people's well-being, but when the market is plunging because regular people will soon be able to afford less of everything, it's a decent metric. We’ve spent a generation building a highly interconnected global economy, and the White House just blew it to smithereens. And it may well get worse—the administration is already talking about raising the tariff on Chinese goods to 104 percent.

Just buy American and avoid the tariffs? It’s not that straightforward. If it were, we wouldn’t be seeing so many MAGA apologists—who were all tweeting “have fun being poor” six months ago—suddenly peddling the idea that money isn't real:

Buying American is not that straightforward because the global supply chain is unfathomably interlinked and the tariffs hit every part of it, not just ready-to-sell goods. So if you’re Google and you make Pixel phones in China, you’re going to pay a lot more to get your phones onto shelves in Texas, and the odds are that you’ll jack up prices to compensate. But even if you’re a small company that actually builds stuff in Texas, if you get any of your raw materials from outside the U.S., your costs are almost certainly going up, too. How much they’re going up will depend on what you’re buying and where it’s coming from, but considering that some of the new tariffs apply to imports from islands that are literally uninhabited, you’re unlikely to be spared. (Congratulations if you import everything from Russia, though!)

So if your product requires plants that don’t grow in the U.S., cloth that’s not woven in the U.S., metals that are easier to mine outside the U.S., or parts that are cheaper to fabricate outside the U.S., your business just got hit with a large tax increase. You’ll have to decide whether to eat the cost, if you can, or pass it on to your customers by raising prices.

And that’s the point I want you to remember here: These tariffs are tax increases levied by the American government on Americans. Because it’s easy to describe tariffs in nationalistic terms (Trump escalates trade war against Asia!), and it’s easy to disguise their real nature by making them sound like events at some sort of far-flung economics Olympics. But they’re just taxes, and they’re taxes on us. This isn't Trump making foreign countries pay. It's Trump making you pay, and everything else around this issue is just a lot of hand-waving, much of it from blindsided dudes on the right trying to argue themselves into believing that they weren’t just betrayed by the president.

Blindsided dudes on the right, you say? Let’s check in on what Bitcoin did after the tariff announcement.

And all this leads to one gigantic question, the question everyone is asking, a question so vital I’m about to give it a special font:

WHY, WHY, WHYYYYYYYYY IS HE DOING THIS??

Why, why, why would Trump impose a policy that instantly deep-sixed the stock market while causing immediate and profound pain to his most loyal voters?

Traditionally, the justification for tariffs is that they stimulate local manufacturing. You make foreign goods harder to buy (that is, more expensive, because the tariffs raise prices), so people buy domestic goods instead. Does that $3,000 set of Slovenian plate mail now cost $4,500? Huh! Maybe I'll take a look at what blacksmiths are putting out in Ohio. And if enough people start buying from American blacksmiths, maybe new blacksmiths will set up shop and the whole domestic melee-protection-apparel industry will blossom.

There can be good reasons to impose policies like this! In a stable economy—say, one that hasn't been thrown into artificial volatility by a punitive tariff regime—targeted tariffs can stimulate domestic manufacturing. They're unlikely to have the same effect if they're so extreme and so scattershot that they crash the global economy, but still. Reviving domestic manufacturing is something Trump likes to talk about, and he's sometimes given it as a rationale for imposing tariffs.

So with regard to the big question above? Call this possibility no. 1.

A second, related justification for tariffs is that they reduce trade deficits. A trade deficit is what you get when you buy more from someone than you sell to them. Economists disagree about how important they are, and they're not inherently a sign of a weak economy. Often, they're the opposite; you buy more when you have more money. But tariffs can reduce trade deficits by reducing the amount people buy. (Because, again, people buy less when the things they buy get more expensive.)

Trump often sounds obsessed with trade deficits. He sees them as a sign that America is being "ripped off." This is a very strange interpretation of how buying and selling works! When I go to the store and buy something, I incur a trade deficit with the store, but most of the time I don't feel like I got ripped off. The store got my money, I got something I wanted, everybody wins. But Trump—and this may be a window into how he himself does business—seems to see every buyer as a mark and every seller as a con artist. If we're buying more from them than they are from us, we must be the suckers, and if we're the suckers, we need to do whatever we can to reverse the imbalance and resume our rightful place as the alpha grifters of the world.

I am about to type a surreal sentence, but it seems genuinely likely that the bonkers math behind the new tariff rates is the result of asking ChatGPT for a formula to balance trade deficits. Analysts have called this approach “extraordinary nonsense.” I can’t say anything else about it because the idea of using Grok or Claude to set global trade policy makes my eyes pop out of my head and boing around on springs.

Call this possibility no. 2.

A third, and slightly more unusual, justification for tariffs is that they bring in tons of money for the government. Trump talks about this one a lot, although as Chris Hayes pointed out a few days ago, the press has a weird tendency not to report it when he does so:

Trump’s idea, as Hayes explains, is that he can bring in so much revenue through tariffs that he can abolish the income tax and fund the whole government through import fees. OK, wow! No income tax! That doesn’t sound so bad, right? Except … in fact, it would represent a catastrophic upward shift in the distribution of American wealth. Rich people, who pay higher income tax, would suddenly contribute much less to funding the government and would get richer, while you and I, who still have to buy food and clothing and school supplies, would contribute much more and would get poorer.

So one big problem with possibility no. 3 is that it would shatter the American social contract and make most people much poorer than they currently are. Another problem is that possibility three is in direct conflict with possibilities one and two. Why? Because the first two possibilities make sense only if tariffs reduce the amount of stuff we import: We want fewer foreign goods in order to erase our trade deficits and revive American manufacturing. But the third possibility makes sense only if we import more stuff: We need lots and lots of foreign goods flowing into the country so that the revenues can pay for fuel for our fighter jets and concrete for our freeways and salaries for the right-wing TikTok stars who now run our national security apparatus.

So which is it? Are we trying to stimulate a domestic smartphone manufacturing industry, which means stifling foreign trade, or are we trying to redistribute middle-class wealth to billionaires by killing the income tax, which means fostering foreign trade? No one seems to have a clue, even among the president’s advisers, and I suspect that the answer is yes, no, maybe, all or none of the above, depending on the time of day and the person asking the question and the pattern of light and shadow playing on the curtains in the room.

The last possible rationale for the tariffs—possibility no. 4—is the one I’m calling the Smack You Right in the Damn Mouth Society.

It goes like this. I just founded a new club. It’s called the Smack You Right in the Damn Mouth Society. The point of the club is that I get to smack you right in the damn mouth. I’m the chairman; everyone else is a member. The chairman gets to smack whoever he wants, whenever he wants. Obviously, before the club was founded, I was not at liberty to smack whoever I wanted right in the damn mouth. Now I am. To me, this club rules.

Didn’t ask to join the club? Too bad. You’re in it anyway. And don’t think you can smack me back—that’s against the bylaws.

Only the thing is: As chairman, I can suspend the rules whenever I want! I don’t have to smack you in the mouth. I can spare you! If you please me and I’m in a good mood, maybe I will spare you. Obey all my whims, and we’ll see. Flatter me, buy my memecoin, spend a lot of money at my various pseudo-businesses, tweet about what a genius I am, and who knows? You might get out of this thing without a broken jaw.

And if I do spare you? Oh, wow. You are going to love me so much. He was looking out for me all along, you’ll say. He’s my protector.

The beautiful thing about tariffs, from the White House’s perspective, is that they can be imposed, lifted, increased, changed, whatever, with almost as much capriciousness as my mouth-smacking policy. Do something the president doesn’t like? Boom. Tariff. Sign a deal to let Jared Kushner finance an 80-story skyscraper in rural Slovenia? Boom. Plate mail flies free. Will rapid reversals like this wreak utter havoc on the world economy and spread pain and fear among regular Americans, including “fuck your feelings” crypto diehards and Gamergate-pilled DOGE cheerleaders? Yes. And so what? I’m the chairman of the Smack You Right in the Damn Mouth Society, not the chairman of the Make Life Good for Literally Anyone Else Institute.

If, as I suspect, we’re about to see a lot of sudden and suspicious tariff exemptions, loopholes inserted for Trump cronies and lapdogs, and general gangsterish manipulation of trade policy, then it will be grimly fascinating to see how Trump’s allies in the business, finance, and tech worlds respond. They had it so much better before! But there are always people ready to thank the bully who spares them from the harm he threatened to cause them himself.

I imagine we’ll see plenty of that attitude among the oligarchic right, and if we do—well, it’s nice to know that at least one form of free trade is still flourishing in America. Call it an equal exchange: They finally get to learn that money can't buy happiness, and I finally get to learn why it's fun to laugh at cucks.